Wealth Management

While many advisors and advisory companies are mainly focused on investments, Forsyth Wealth Management is concentrated on our total financial relationship with our clients. We provide a wealth management experience that addresses the entire range of your financial concerns, not just investments, within the context of a long-term relationship. We do not take on new wealth management clients unless we can add significant value to our client’s lives.

Managing your wealth means balancing a wide array of concerns:

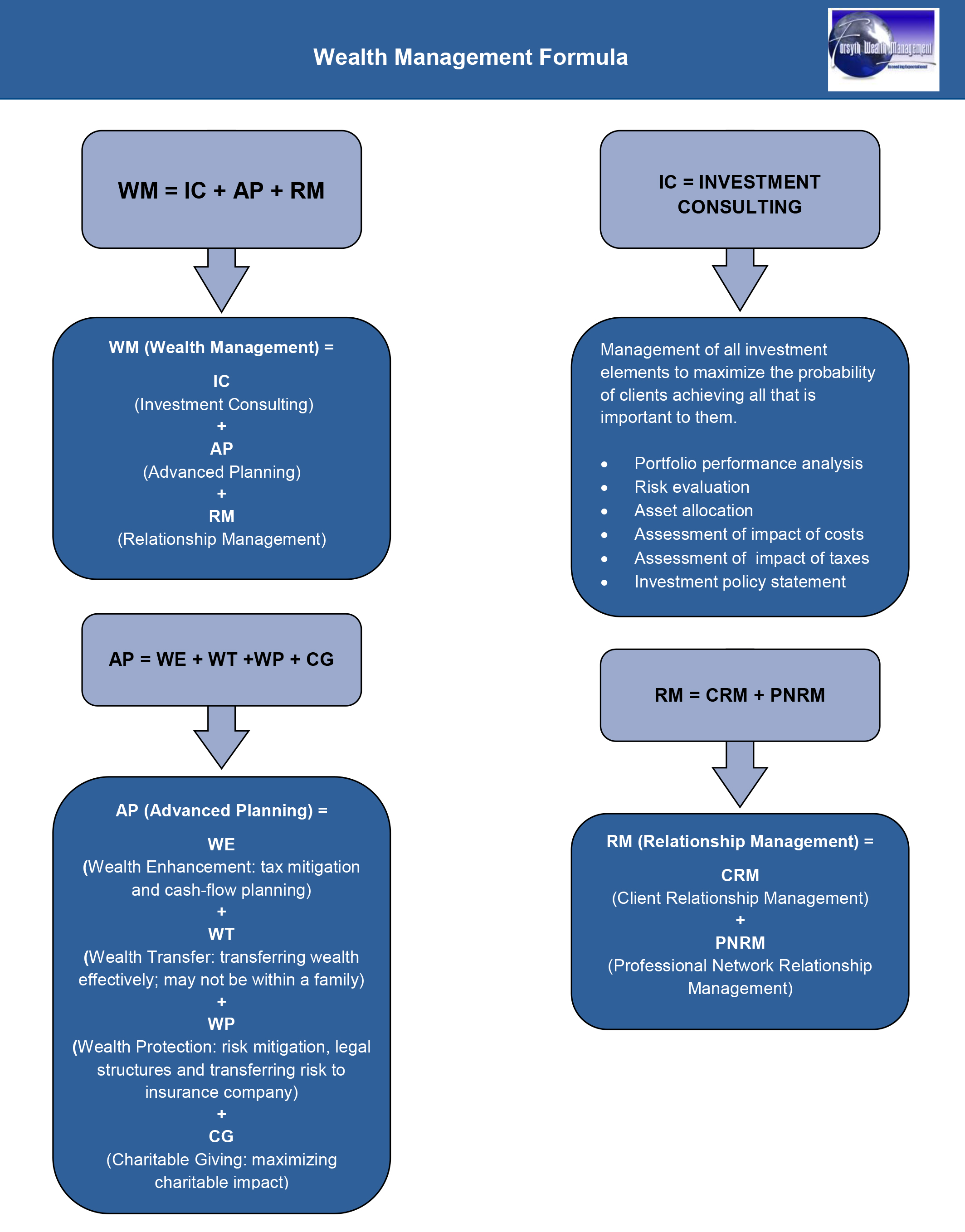

Growing Your Wealth.

Wealth preservation. Wealth preservation is not just about not losing money. It is about having enough money to fund your lifestyle and to be able to do what you want to do, whether that is simply to retire securely and pay for their children’s education or to take care of multiple homes or buy a boat.

The way to achieve this is through astute investment management that produces optimal returns consistent with your time frame and tolerance for risk. Thus, wealth preservation is a primary area of focus.

Managing Risk And Reducing Taxes.

Wealth enhancement. The goal of wealth enhancement is to minimize the tax impact on your investment returns while ensuring the cash flow you need.

Taking Care Of Your Loved Ones.

Wealth transfer. This is about finding and facilitating the most tax efficient way to pass assets to a spouse and succeeding generations in ways that meet your wishes by planning for the eventual transfer of your estate or the succession of your business.

Protecting Your Assets From Being Unjustly Taken.

Wealth protection. This includes all concerns about protecting wealth against catastrophic loss from potential creditors, litigants, children’s spouses and potential ex-spouses, and identity thieves.

Making Your Charitable Concerns Count By Efficiently Leaving The Legacy You Desire.

Charitable giving. This encompasses all issues related to fulfilling the client’s charitable goals in the most impactful way possible. It can often support efforts in other areas of concern.

We have structured our practice in this manner so this distinguishing feature sets us apart from most other advisors and firms.

That requires that we not only understand each of these issues, but also how they interact in order to develop a comprehensive set of solutions. Not cookie-cutter solutions, but those driven by probing questions and a deep understanding of your unique circumstances, your family, and your goals.

For example, after an exhaustive search, we hire and work with the best and brightest of the asset managers in the asset manager universe to work on our client’s behalf.

We keep in constant contact with our clients. Our clients hear from us in both good times and bad times because we understand that it is during market down turns that our clients need to hear from us most.

For clients that need extensive asset protection, we have relationships with the internationally renowned asset protection attorneys, both in the U.S. and overseas.

These are not just practitioners with experience; they are people who actually write the asset protection books.

We are advisor friendly. Using a holistic approach to wealth management, we routinely use a client’s trusted, qualified-existing advisors to help formulate and implement a plan.

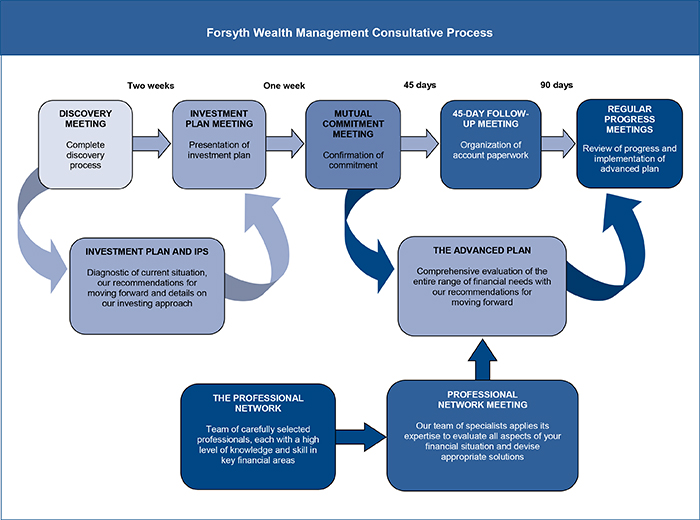

How Do We Help You Achieve Your Wealth Management Goals?

Our Vision For You

If you want to succeed, you must be successful on purpose. It is unlikely for most people to haphazardly stumble into great success. Instead, you need a deliberate, focused approach to forging a highly profitable wealth management plan that serves you well and provides you with the lifestyle you want.

We define “success on purpose” this way:

- Vision: Knowing exactly where you want to go, what type of lifestyle and retirement you want to build.

- Focus: Focusing your wealth management activities only on those that bring you closer to achieving your goals.

- Deliberation: Moving thoughtfully as you prioritize actions, articulate your plans, and consistently review your them to keep them on track.

- Confidence: Knowing that, because you are staying the course, that your diligence will add significant value to the lives of your family and loved ones.

To help you keep on track we provide the following.

- Collaboration: We enlist professionals to help you. This includes not only our internal team, but also strategic partners, industry experts, and of course your existing advisors when needed.

- Consistency: By employing the most cutting edge technology, we do things at the same high level in the same way all the time in order to ensure you a top-quality experience.

We Care

It’s sometimes said that people don’t care how much you know until they know how much you care. By working very closely with our clients through our consultative client-relationship, management approach, we can demonstrate how much we care for you and your family’s wealth management needs.

We strive to continually strengthen our client relationships, by building on the foundation our wealth management engagement so that it is in alignment with your goals and objectives, and helping you achieve the lifestyle you desire.

Commit to Lifelong Learning: The biggest asset any of us has is our human capital. We continually nurture our company’s human capital and the human capital of the members of our team. Your benefit is new ideas, perpetual enthusiasm and enhanced skill sets in those that help guide you through the wealth management process.

Many of us know that we need to embrace wealth management and do proper financial planning but sometimes we become polarized because the sheer amount of work that is involved.

But there are two pieces of good news here that we want to tell you about.

First: You’re not alone. Many people are frustrated because of what seems like an overwhelming set of tasks and organization required, even if they think they know what they should do next.

But knowing what you need to do and actually doing it are two very different things. We call this distinction the “knowing-doing gap.”

As Yogi Berra said, “In theory there is no difference between theory and practice. In practice there is.”

Second: We do this for a living and have done this for over thirty-five years. Forsyth Wealth Management can move you directly from thinking into successful action and make this seemingly insurmountable obstacle that you face in to an organized, efficient financial plan for you and your family.

Obviously, if you don’t act, you won’t get the rewards that come from taking action. And if you don’t take action you are unlikely to achieve the transformative changes you desire.